If you read my post Retire with Confidence: The 3% S&P 500 Plan for Today, you know I’m a fan of simplicity—and results. That post focused on a strategy of investing 100% in the S&P 500 and withdrawing 3% a year, adjusted for inflation. But what about the classic “safe” choice: a 60/40 portfolio of stocks and bonds?

We’ve all heard the pitch: a 60/40 mix promises market gains with less volatility. Sounds ideal—on paper.

Let’s see how it actually performs compared to a plain old 100% stock portfolio—over full 30-year retirement periods.

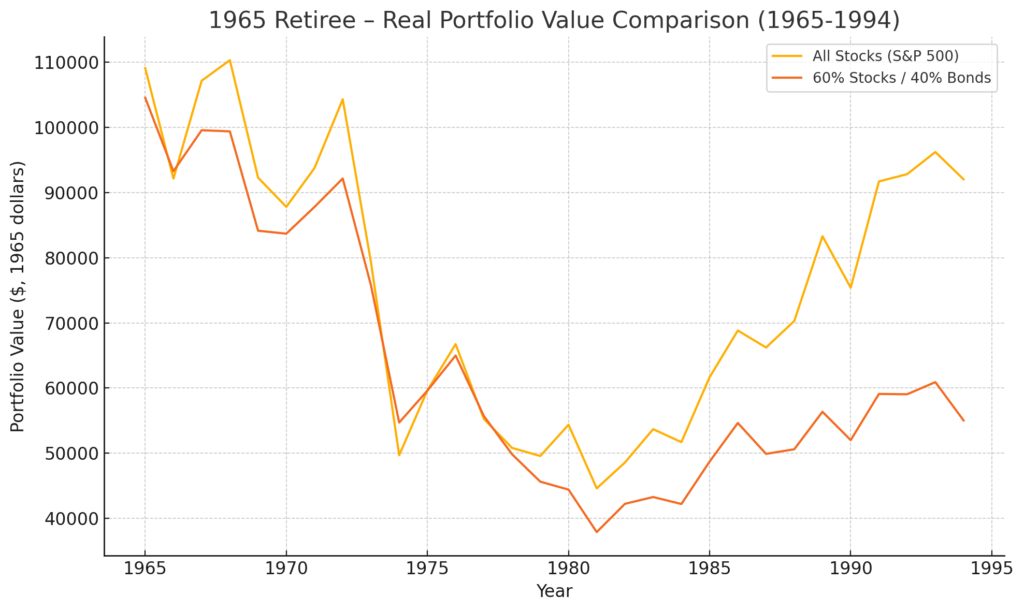

Case Study #1: Retiring in 1965 — the Worst Year for Stocks

Let’s start with one of the toughest test cases for the all-stock strategy: retiring in 1965. Over the entire analysis period from 1926 to 1995, this was one of only two years (along with 1966) where the retiree ended with less than their original purchasing power.

Even so, the all-stock retiree, using a 3% inflation-adjusted withdrawal rate, still ended up with $92,000 in real value at the end—just under their $100,000 starting point.

The 60/40 retiree? Not so lucky. They ended up with $55,000 in real value. That’s 40% lower than the stock investor.

Surely the 60/40 portfolio at least smoothed out the ride? Nope. It underperformed stocks in 29 out of the 30 years. The only exception? 1974, when it ended at $55K while stocks dipped briefly to $50K. Otherwise, stocks were ahead every single year.

So what exactly were you getting with 60/40 in this case? Lower returns, consistently. Sounds like a winning proposition… if you’re trying to win the “least growth possible” award.

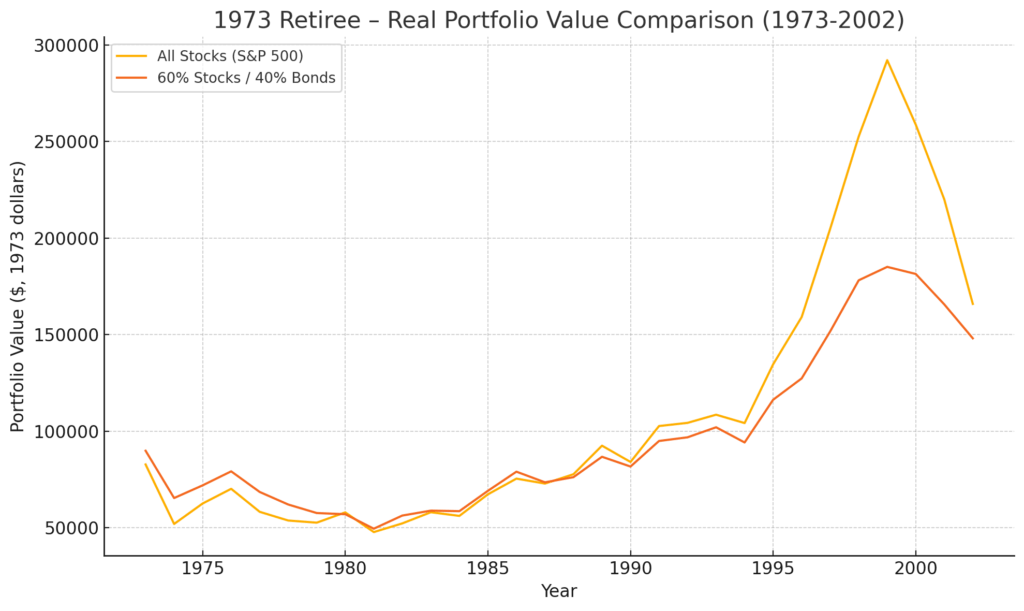

Case Study #2: 1973 — A Rough Start, but Still Not Enough

Let’s look at another tough year: 1973. (A great year to be born—maybe not to retire.)

Stocks took a hit early on, and the final year (2002) saw a real drop in value. But over the full 30-year period, the 100% stock retiree still came out ahead—again beating the 60/40 portfolio in most years and finishing stronger overall.

Yes, the last year was rough, but the long-term edge remained. If your goal is “never losing money you never had,” then 60/40 wins. But if you’re interested in building wealth? Score another one for stocks.

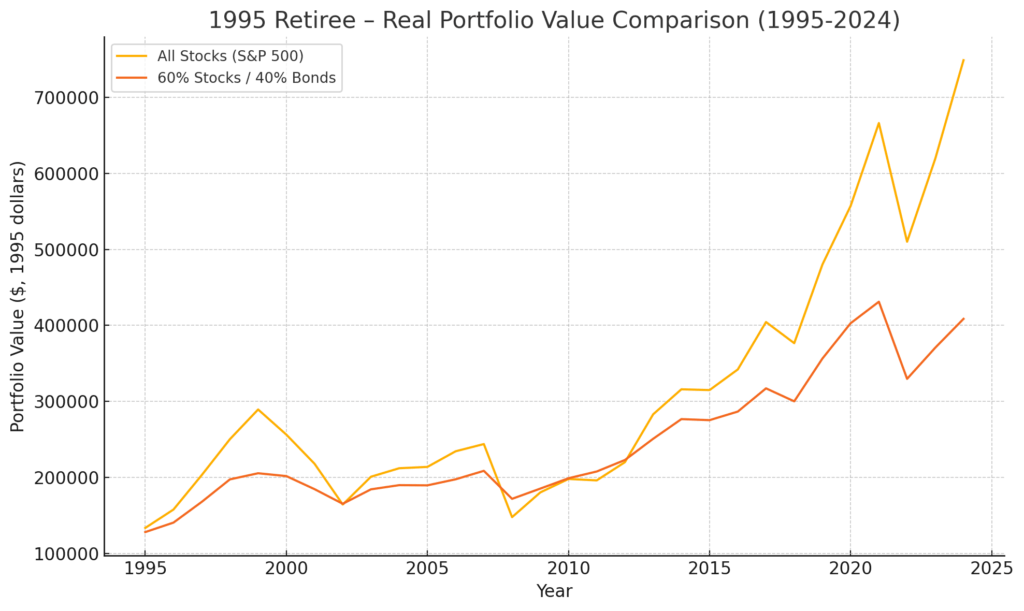

Case Study #3: 1995 — What a Year for Stocks!

Now let’s flip the script and look at a great year to retire: 1995.

The 100% stock portfolio didn’t just win—it exploded. The retiree’s portfolio grew to over 7 times its original purchasing power.

The 60/40 portfolio? Still solid, but ended at only 4x the original purchasing power.

And all that underperformance… for what? A few years of slightly smaller losses?

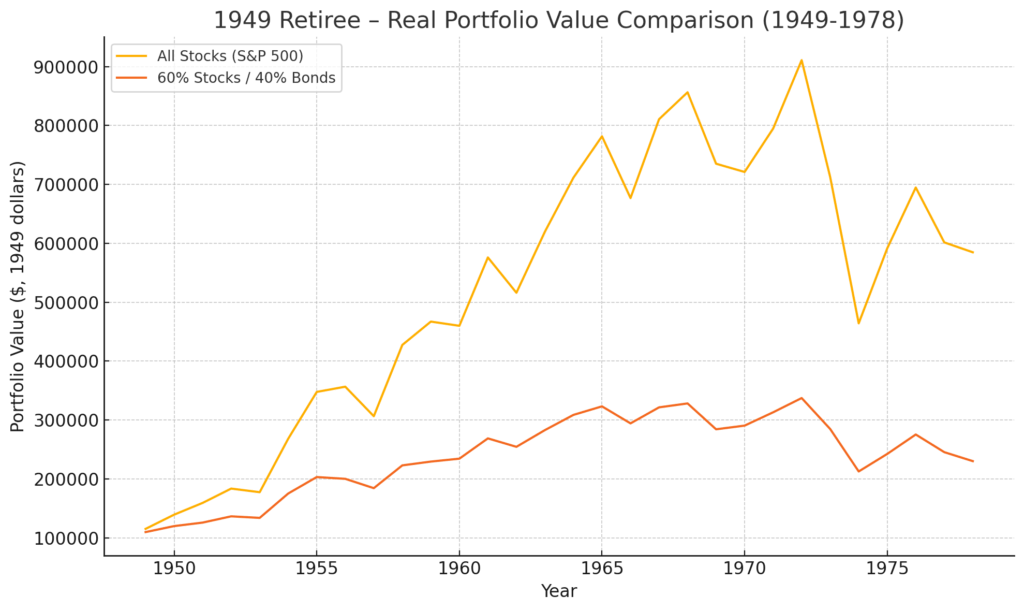

Case Study #4: 1949 — Consistent Wins for Stocks

Pick a post-war year like 1949. Once again, stocks win every year. The gap widens over time. Whether you live to 80 or 100, you—or your heirs—come out well ahead with the all-stock approach.

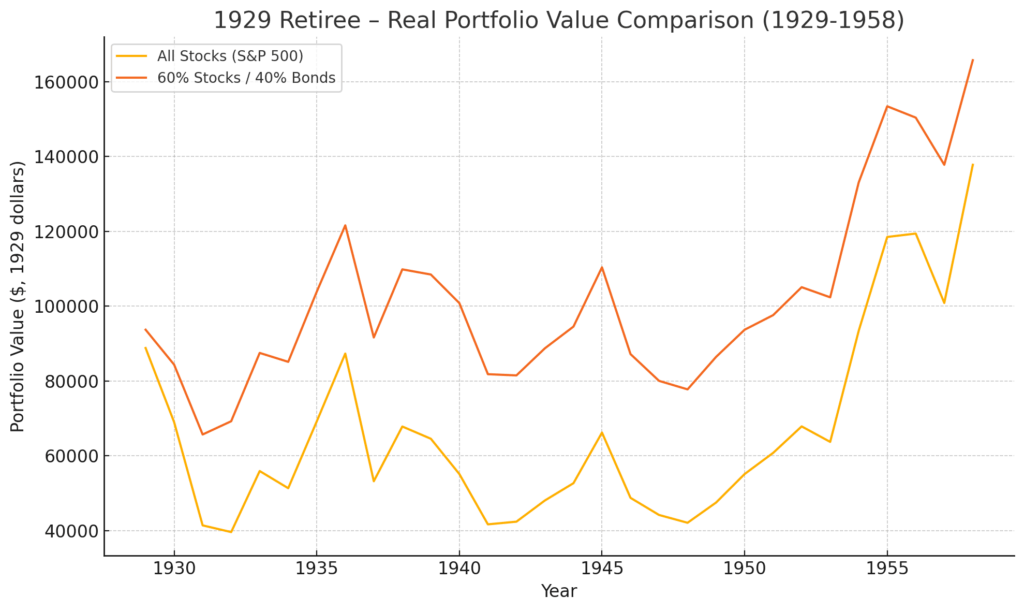

Case Study #5: 1929 — The Great Depression Exception

Ah, 1929—the one year that breaks the rule.

If you retired at the dawn of the Great Depression, the 60/40 portfolio beats the S&P 500 across the board. It outperformed every single year, including the final one. No debate here: this is where the 60/40 strategy shines.

So… What’s the Takeaway?

Unless we’re heading into another Great Depression, the 100% S&P 500 strategy outperforms the 60/40 portfolio in almost every 30-year retirement scenario we looked at.

Sure, 60/40 might give you fewer scary years. But it also gives you less money nearly every year.

If you really believe the apocalypse is coming, maybe skip the bonds altogether and go full doomsday: gold, guns, and ammo.

But history tells a different story.

You could bunker down and prepare for financial Armageddon… or you could stay invested, stay patient, and let long-term market growth do the heavy lifting.

For long-term retirees, the S&P 500 still looks like the better bet.

If you enjoy this post, stay tuned for more on how to accumulate and growth wealth for your financial freedom.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Always consult with a professional before making financial decisions.

Very well written!

Thank you for the review!

Very well written!