(And Why Tax-Free Compounding Is a Game Changer) – Roth IRA Benefits

Prefer to listen? 🎧

Click here to listen to the podcast version of this guide.

Saving, Investing, and Tax Efficiency — the 3 Keys to Building Wealth

When I made my very first IRA contribution, I remember looking at the paperwork and thinking: “59 ½? That’s decades away! Why would I save for something so far in the future?”

Well, now I’ve seen the benefits of a Roth IRA firsthand — and I can say this: It was absolutely worth it.

At the time, it was hard to picture life that far ahead. But now, after years of learning and experience, I can tell you this: Saving and investing over long time horizons is one of the most reliable paths to building real wealth.

💡 If you’ve read my post How to Start Investing with Just $100, you’ve already seen how powerful a simple monthly habit can be. Add a Roth IRA on top, and the tax savings alone can end up being greater than your total contributions. That’s icing on the cake — a smart move made even smarter.

And here’s something else I’ve learned — it’s not just about saving and investing. Tax efficiency is a powerful third lever that can quietly add tens of thousands of dollars — or more — to your future wealth.

In this post, I’ll walk you through why the Roth IRA is one of the most tax-efficient tools available — especially for younger or earlier-career investors with time on their side.

We’ll look at a real example using my free Roth Extra $$s Calculator (available to subscribers — subscribe below!). The numbers may surprise you — in our example, the tax savings from using a Roth IRA end up being larger than the total amount contributed over 35 years.

The key lessons are simple but powerful:

✅ Save consistently

✅ Invest wisely

✅ Use tax efficiency to keep more of what you earn

What Is a Roth IRA?

A Roth IRA is one of the simplest — and most effective — tools for building long-term, tax-efficient wealth.

Here’s how it works:

- You contribute after-tax dollars today (money you’ve already paid income tax on).

- Your investments grow tax-free inside the account — no taxes on dividends or capital gains.

- When you retire (after age 59½), you can withdraw both your contributions and earnings 100% tax-free.

Why Roth IRAs Are So Powerful

✅ Tax-free growth — every bit of compounding works for you, not the IRS.

✅ Tax-free withdrawals — you keep everything you’ve built.

✅ No RMDs — unlike Traditional IRAs, you’re not forced to withdraw money.

✅ Flexibility — you can withdraw original contributions any time, tax- and penalty-free.

2025 Contribution Limits

- Up to $7,000 per year ($8,000 if age 50+) — as long as you have earned income.

See IRS Roth IRA contribution limits for the latest details.

Income Limits for Direct Contributions

- $146,000 for single filers

- $230,000 for married filing jointly

For Higher-Income Investors: The Backdoor Roth Option

If your income rises above the limits — a good problem to have! — you can still use a backdoor Roth IRA:

- Contribute to a non-deductible IRA

- Then convert to a Roth IRA

Note: having pre-tax IRA funds can complicate this, which is why I encourage starting with Roth contributions early. Keeping your Roth Backdoor open gives you more flexibility later.

Roth IRA vs Taxable Account

| Account Type | Growth | Taxes on Withdrawals |

| Roth IRA | Tax-free | None — fully tax-free |

| Taxable Account | Taxable annually (dividends, capital gains) | Capital gains taxed when sold |

Why Roth IRAs Are Ideal for Younger Investors

Lower Tax Brackets

Early-career investors are often in lower tax brackets — perfect for making Roth contributions while tax costs are low.

More Time for Tax-Free Compounding

The earlier you start, the more decades of tax-free growth you’ll enjoy.

In fact, in the example we’ll see next, the tax savings alone exceed the total contributions!

Flexibility for Life Changes

- Withdraw contributions anytime

- No forced withdrawals

- Still eligible for backdoor Roth if income rises later

Parents Can Help

When my kids start working, I’ll recommend a Roth IRA — and may gift them funds to contribute. This is one of the best financial gifts a parent or grandparent can give.

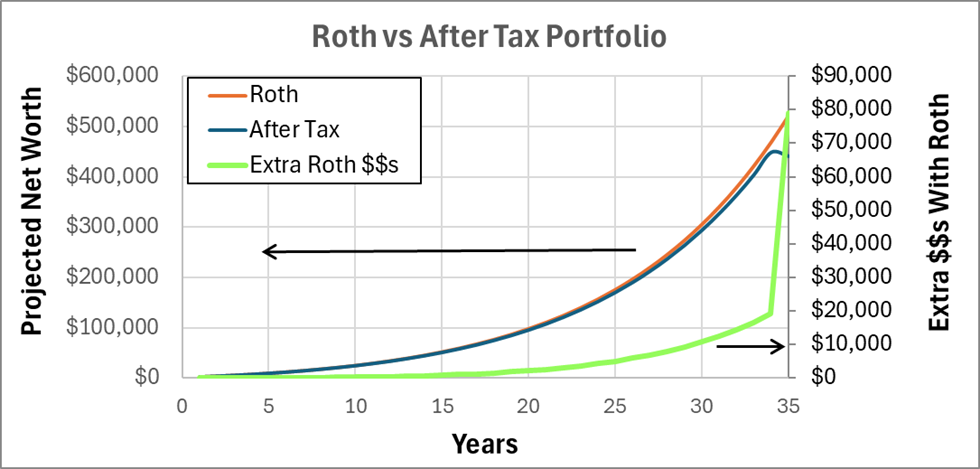

The Example: Roth vs Taxable After 35 Years

Scenario:

- $100/month saved

- 35 years invested

- 10.4% annual return

- S&P 500-style portfolio (tax-efficient)

- Full sale at year 35 in taxable account triggers capital gains tax

| Results: | Value |

| Total Cash Invested | $72,554 |

| Projected Extra Roth $$s vs taxable | $79,016 |

What the Chart Shows

At first glance, the Roth and taxable growth lines almost overlap — because saving and investing consistently is the biggest driver of wealth. The light green line highlights the Roth IRA Benefits.

Look closely:

- The Roth IRA is ahead by ~ $20,000 after 34 years (avoiding the tax drag of dividends)

- The taxable account takes a capital gains hit at year 35 when the assets are sold.

- The Roth IRA is fully tax-free.

That difference at year 35— $79,000+ extra — not trivial!

And this example already uses a tax-efficient stock strategy. If you invest in bonds or high-dividend stocks, the Roth advantage grows even larger.

The Bigger Lesson: Tax Efficiency as a Wealth Multiplier

In my earlier years, I didn’t fully appreciate tax efficiency. I knew the concept — but it really hit home after buying T-bills and seeing:

- T-bill interest taxed as ordinary income

- Plus Net Investment Income Tax (NIIT) for higher earners (another 3.8%)

Suddenly, tax drag was very real.

Roth IRAs avoid all of this:

✅ No NIIT

✅ No ordinary income tax

✅ No capital gains tax — ever — on qualified withdrawals

Tax efficiency quietly amplifies the impact of saving and investing.

How to Get Started with a Roth IRA

1️⃣ Open a Roth IRA — Vanguard, Fidelity, Schwab are all good options.

2️⃣ Automate contributions — $100/month is a great place to start.

3️⃣ Invest for growth — broad market index funds, low-cost.

4️⃣ Parents/grandparents can help — gift contributions for kids with earned income.

5️⃣ Try my calculator — use the free Roth Extra $$s Calculator when you subscribe below and then model your own success plan!

Want to brush up on smart investing basics? Check out my post Investing — Getting Started — it pairs perfectly with using a Roth IRA.

Roth IRA Benefits Recap

✅ Tax-free growth

✅ Tax-free withdrawals

✅ No RMDs

✅ No NIIT

✅ Great estate planning flexibility

✅ Ideal for young investors — and for parents helping them

FAQ

What if I need the money early?

You can withdraw your original contributions any time, tax- and penalty-free.

What if my income gets too high?

You can use a backdoor Roth strategy to continue contributing.

Can I contribute to both a Roth IRA and a 401(k)?

Yes — you can contribute to both in the same year.

Final Takeaways

✅ Saving and investing consistently builds wealth.

✅ Tax efficiency matters — the Roth IRA added $79K in extra value in this example.

✅ Parents/grandparents can help kids start early — compounding for 50+ years.

✅ Starting early matters most — if I could tell my younger self one thing:

“Start the Roth early. You’ll thank yourself later.”

If you found this post helpful, you might also enjoy:

👉 What’s the Shortest Time You Should Invest in Stocks?

👉 Investing — Getting Started

Ready to take the next step?

✅ Open a Roth IRA.

✅ Automate your contributions.

✅ Try my free Roth Extra $$s Calculator by signing up below to the subscriber list.

Saving, investing, and tax efficiency — that’s how wealth is built.

👉 Like what you’re learning? Subscribe below to get my latest posts straight to your inbox — plus instant access to my free tools: the Portfolio Growth Calculator (featured in Investing – Getting Started) and the Roth Extra $$s Calculator. Build your financial future smarter — starting today.

Disclaimer:This content is for informational purposes only and is not financial or tax advice. Please consult a professional to determine what’s right for your personal situation.

Great content Kevin!!

Thanks for the comment and feedback!

https://shorturl.fm/Q5g0H

https://shorturl.fm/kap7N

https://shorturl.fm/x6tYg