Imagine This…

It’s 2025. You’ve just landed your first real job (maybe no need to imagine if that’s you!) and you’re determined to be responsible with your money. You start saving $5,000 a year, every year, like clockwork.

Some friends tell you to invest in the stock market. But the headlines are full of doom and gloom. The dot-com implosion, the 2008 financial crisis, the COVID-19 crash, the inflation spike of the 2020s, trade wars, rising interest rates, tech layoffs, and banking scares—it’s all too much. So, you choose what feels safe: cash. No drama. No red numbers. Just steady, calm growth… or so it seems.

But here’s the truth: What looks calm in the moment is quietly and significantly costing you over time.

So, what would have happened if you started back in 1995 and stuck with cash ? Let’s see.

The Data Tells a Painful Story

Two savers. Two paths.

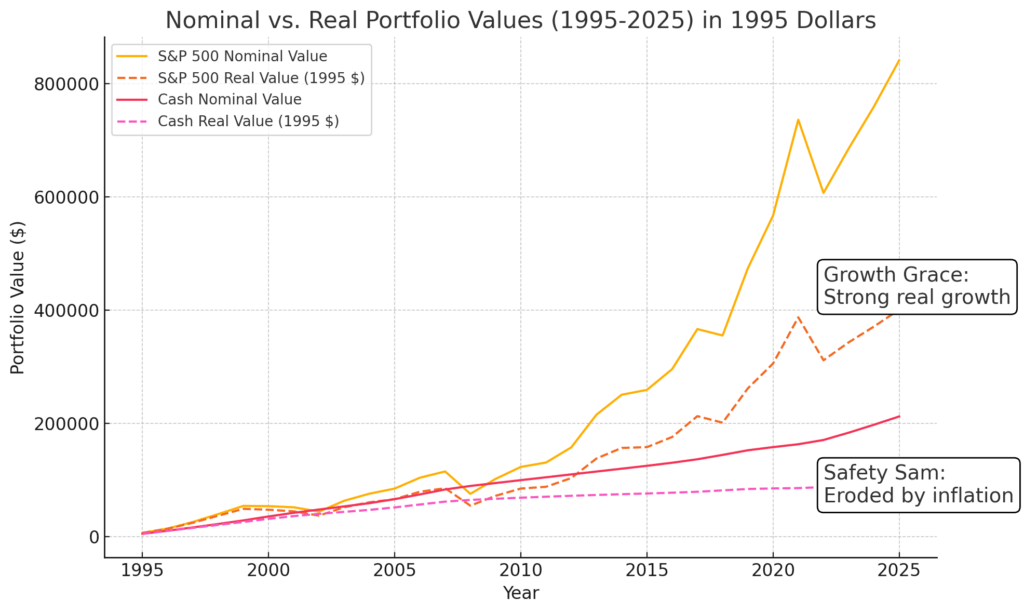

- Growth Grace braved the storms of the S&P 500, staying invested through every gut-wrenching crash and euphoric rally, trusting the long-term compounding power of stocks.

- Safety Sam stuck with cash—rolling over his savings every year into 3-month Treasury Bills, feeling confident that playing it safe would protect his money.

Grace and Sam both put in $5,000 year and the chart shows how their purchasing power grows over time. I’ve show the nominal (actual $s) but that hides the impacts of inflation, so I added real value in 1995 $s to show the corrosive power of inflation. Too many times financial gurus show the compounding growth of money that often looks impressive but ignores inflation. And if you’re not outpacing inflation, nominal value might grow but real value shrinks.

Portfolio Growth Comparison (Nominal and Real Values in 1995 Dollars)

Despite the chaos of the markets, Growth Grace’s portfolio soared in real purchasing power, while Investor Safety Sam’s cash quietly shrank year after year. Grace’s end value had 4X the purchasing power of Sam’s!

The lesson is painfully clear. Stocks, even with volatility, delivered real wealth. Cash, despite feeling ‘safe,’ left the investor poorer every year once inflation took its toll.

“In the ultimate insult, Uncle Sam taxes your shrinking pile of cash as if you’re getting richer—even as inflation is quietly stealing your purchasing power.”

“Congratulations—you earned 2% on your cash! Too bad inflation was 3% and Uncle Sam still wants his cut of your ‘success.'”

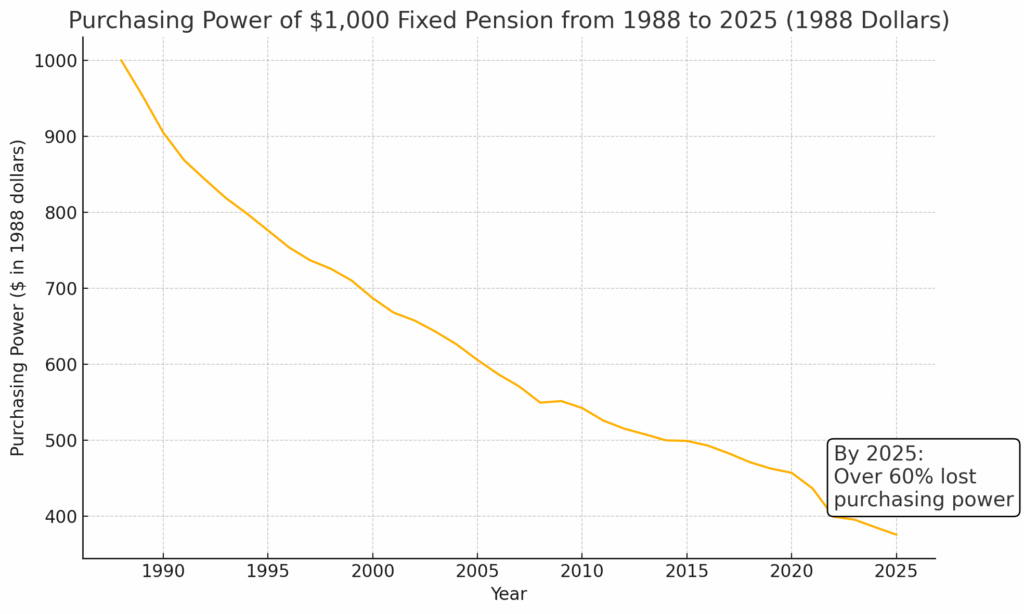

My Dad’s Fixed Pension After 40 Years — So Small It’s Hard to See Now

This wasn’t something I picked up from charts or finance books. It was personal. When my dad retired from Boeing in 1988, his fixed pension felt rock solid. The check showed up every month—same amount, no surprises. I barely thought about it for 30 years. It was always just… there. But when I started helping him with his taxes in 2022, that old check caught my eye—and I did a double take. Seeing that check reminded me why building wealth over decades requires more than relying on “safe” fixed income—it requires owning assets that grow and protect purchasing power. That check, once a big part of his income, now barely moves the needle.

Erosion of a Fixed Pension (1988 to 2025)

By 2025, that same $1,000 pension had lost more than 60% of its buying power. The invisible hand of inflation is relentless.

But here’s the thing: my dad’s story isn’t a cautionary tale—it’s a success story.

He never relied on that pension alone. His steady, disciplined investing—throughout his career and retirement—is what saved him. That discipline let him live generously and enjoy life. Without it? That pension alone wouldn’t have been enough to scrape by—let alone support the retirement and giving he’s doing today.

Safe Isn’t Safe: How I Learned to Look Beyond the Feeling

When I started my career in 2001, I lived through the lost decade—the 2000s. Stocks went sideways. Sometimes, they felt barely better than cash. It felt like a long, lonely journey of patience. Seeing cash accumulate in my account felt good. Tangible. Secure. But I later realized the trap: income now is taxed now (more learnings from doing my own taxes 😊), and cash sitting idle was a sure loser once inflation and taxes were accounted for.

It took me years to trust the math: In the end, numbers beat feelings—only assets that grow protect your future spending power.

The Bigger Lesson: Playing It Safe Is the Riskiest Move

Cash investing is the slow, invisible killer of wealth.

- Inflation quietly devours your returns.

- Taxes punish you as if you’re making money.

- And worst of all? You lose the incredible compounding that comes only from owning appreciating assets.

Cash’s Triple Threat:

- Inflation erosion

- Tax drag

- Lost compounding growth

Real-Life Actions You Can Take Today

- Re-evaluate your cash holdings—keep enough for 6 months of expenses, but beyond that, put your dollars to work.

- Use low-cost index funds for long-term growth. I personally like Vanguard’s Total Stock Market Index (VTSAX) for simplicity and low fees.

- Want to pick some stocks? I like using Fidelity for that—it gives me flexibility without high costs.

Grow, Don’t Erode

Cash might feel comfortable—but history shows it doesn’t keep up. Stocks might feel volatile—but they’ve been the best long-term defense against inflation’s slow grind.

Don’t let fear push you into the false comfort of sitting still while the world moves on. The data shows it. My dad’s pension shows it.The real risk isn’t the market crash you fear—it’s the slow, invisible erosion while you feel like you’re playing it safe.

“Even small investments beat sitting on cash. Learn how inflation quietly kills cash.”

Now you’ve got the data. Use it. Grow your wealth. Protect your future!

Like this post? Watch for my next one—I’ll break down real-world strategies to protect and grow your purchasing power.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Always consult with a professional before making financial decisions.