Helping new investors tame the noise, conquer inflation, and harness the market’s long-term growth in 20 minutes or less.

Prefer to listen? 🎧

Click here to listen to the podcast version of this guide.

Why Start Now?

If you’re thinking about getting started with investing but feel overwhelmed—don’t worry, that’s common. But it doesn’t have to be difficult.

There’s a huge amount of noise out there trying to pull you in different directions (and get you to spend your money). This post is about making it simple—helping you take that first step on a lifelong investing journey that your future self will thank you for.

The Case for Action

Before we jump into the how, let me talk about the why. If you’ve started saving but are new to investing, cash might seem “safe.”

But you’ve probably noticed older folks in your life talk about how cheap things used to be when they were young. That will happen to you too—because inflation is relentless.

If you want to understand just how damaging inflation can be, check out my post on The Destructive Power of Inflation.

Not investing is not a safe option. In fact, doing nothing may be one of the worst choices—because it quietly guarantees a loss of purchasing power over time.

Years ago, a family member (who invested well) told me something that stuck:

“Most people don’t fail to be good investors—they fail to be investors.”

And it’s true. If you don’t believe it, just look at how many people build wealth through homeownership. The returns on a primary home aren’t great once you adjust for inflation and costs (I break this down in my home-buying vs. investing post).

But why do so many people still build equity through homeownership? Discipline.

Paying the mortgage month after month builds wealth—not because the home is a great investment, but because the commitment forces saving and compounding.

Now imagine applying that same discipline to better investment vehicles, like low-cost index funds. I’m a big fan of simple approaches using funds like the Vanguard S&P 500 ETF (VOO), which you can buy through brokers like Fidelity or Schwab.

The Power of Just $100/Month

Let’s look at what $100 per month could do for the future you.

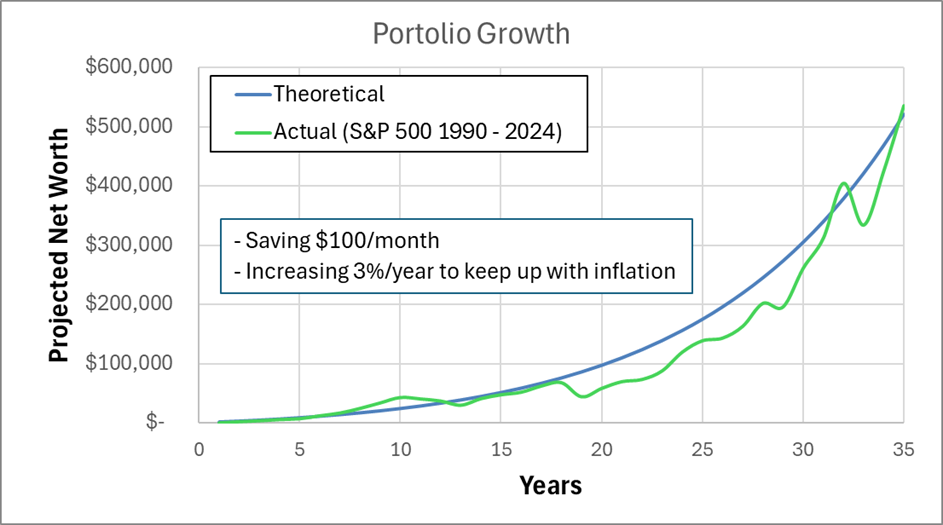

That $100/month, invested in a simple S&P 500 index fund over 35 years, could grow to over half a million dollars.

Here’s the chart: it shows portfolio growth for someone investing $100/month, increasing their savings 3% per year to match inflation.

- The blue line shows a theoretical case with a steady 10.4% return—the long-term average of the S&P 500.

- The second line shows real S&P 500 returns from 1990 to 2024.

You’ll see that over the long term, stock market returns—while volatile in the short run—have historically delivered strong positive growth, far outperforming cash.

$100/Month Investing: S&P 500 Returns vs. Cash (35 Years)

| Scenario | Ending Value* |

| 10.4% per year (long-run S&P 500 average) | ≈ $520,887 |

| Actual S&P 500, 1990–2024 | ≈ $535,718 |

| Cash | ≈ $72,555 |

Assumes you invest $100/month in Year 1 and boost contributions 3% annually to match inflation. Cash scenario assumes zero investment return.

Even real-world returns—though volatile in the short run—tend to converge on the long-term average over a 35-year stretch.

Sitting in cash, by contrast, would have left you with a portfolio nearly 90% smaller than an invested one, with inflation slowly eating away at your savings the entire time.

Where Should You Invest?

So where exactly should you put your savings?

I like Vanguard, Fidelity, and Schwab—they all offer low-cost investing options. Once you’ve taken the most important first steps—saving and investing consistently—the next key is keeping your costs and taxes low.

All three of these brokers do a solid job with low fees and tax efficiency. The Vanguard S&P 500 ETF (VOO) is a great example: it’s low-cost, broadly diversified, and fairly tax efficient. You can buy it easily through any of these firms.

There are certainly other good options out there, but I personally favor Fidelity for a few reasons:

✅ Cash earns a competitive yield — Fidelity’s default core position for your cash is the SPAXX money market fund, which pays ~3.9% as of this writing. That’s a lot better than letting your cash sit in a typical checking account earning nothing.

✅ Bank-like features — You can write checks and pay bills online directly from your Fidelity brokerage account. You’ll always want to keep some cash for an emergency fund and everyday spending—and I like earning a little extra on that cash while it sits. I got tired of earning near 0% at my local credit union and switched to Fidelity. Now it’s nice seeing that little deposit of “free” interest on my cash each month!

✅ ATM/debit card — Fidelity also offers an ATM/debit card linked to your brokerage account for added convenience.

Step-by-Step: How to Open a Fidelity Account and Buy Vanguard S&P 500 ETF (VOO)

What You’ll Need

- Government ID and Social Security Number

- Bank account & routing number

- ~15–20 minutes of quiet time

1. Choose Your Account Type

| Goal | Suggested Account |

| Long-term, taxable investing | Individual Brokerage |

| Retirement (tax-advantaged, under income limits) | Roth IRA |

| Retirement with current-year tax deduction | Traditional IRA |

Tip: If you qualify for a Roth IRA, start there—the growth is tax-free forever.

2. Create Your Fidelity Login

- Visit Fidelity.com → Open an Account.

- Pick the account you chose above and click Open Online.

- Enter personal info, contact details, and employment status.

- Review & e-sign the Customer Agreement.

3. Link and Fund Your Account

- Choose Link a Bank. (You can also have your pay direct deposited.)

- Log in to your bank (instant) or enter routing/account numbers (2–3 days).

- Transfer your first contribution (e.g., $100). Fidelity charges $0 to move money in.

4. Place Your First Trade—Buy VOO

- On the Fidelity dashboard, click Trade → Stocks/ETFs.

- Enter symbol VOO (Vanguard S&P 500 ETF).

- Action: Buy

- Quantity: Enter dollar amount or shares. Fidelity supports fractional shares down to $1.

- Order Type: Market (for beginners, fine during market hours).

- Time in Force: Day.

- Preview Order → Submit.

Cost check:

- Commission: $0

- ETF expense ratio: 0.03% (that’s 3¢ per $100 per year)

5. Automate and Forget

- Go to Accounts → Automatic Investing & Transfers.

- Set a recurring bank transfer (e.g., $100 on payday).

- Toggle Automatic Fractional Investing for VOO so every deposit is invested the same day.

6. Rinse, Review, Rebalance (Rarely)

- Check in once or twice a year.

- Increase your contribution when you get a raise.

- Avoid the urge to time the market—history shows time in the market beats timing it.

Common Questions

“Why Fidelity if I’m buying a Vanguard fund?”

Fidelity offers $0 commissions, an effortless interface, fractional shares, and top-tier customer service. Vanguard’s ETFs trade the same everywhere.

“Is $100/month really enough?”

It’s a start. The habit matters more than the dollar amount. As your income grows, bump the contribution. The numbers above show the compounding power.

“What if the market crashes right after I invest?”

History is littered with crashes—and every single one has been followed by a new high. With a decades-long horizon, downturns are opportunities, not threats.

“What account type should I open?”

If you’re investing for retirement and qualify, a Roth IRA is a great place to start because future growth is tax-free. For general investing, an Individual Brokerage Account offers flexibility with no income limits.

Keep It Simple, Stay the Course

Inflation is relentless—but so is compounding.

Plant your first $100 today by opening your Fidelity account, buying the Vanguard S&P 500 ETF, and automating your investing.

With this simple, beginner-friendly investing strategy, you’ll harness the power of compound growth over time. Your future self will thank you.

👉 Next step: Subscribe below and I’ll send you instant access to my Free Portfolio Growth Calculator—a simple spreadsheet where you can enter your monthly savings, planned annual increase, and time horizon to watch your future portfolio snowball in real time.

Disclaimer: This post is for educational purposes and does not constitute personalized investment advice. Investing involves risk, including possible loss of principal.

Great post! I’m just getting started myself, and this will make it easy.

Glad I could help!

https://shorturl.fm/KeVJ4